This essay originally was published on June 1, 2023, with the email subject line "CT No.169: A deliberate weirdening of content-focused data gathering."

Content strategy is a dance. It takes artful maneuvering to charm humans with poetry, appease algorithms with keywords, and win revenue with strategic budgeting. But you can't stun the audience if you're using the same moves as everyone else.

With algorithms homogenizing our feeds, it takes extra effort to look outside the usual places for inspiration. The good news: your competitors are as uninspiring as ever. The bad news: you run this risk as well if you’re feeding yourself the same inputs—using the same public AI platforms, drinking data from the same APIs, or reading the same newsletters and trend reports as everyone else.

These sources can provide utility, but creating content with an edge requires diversifying your inputs. Your brand won’t stand out unless you search deeper and farther than everyone else. Unless you build your own ethnographic toolbox and travel to unexplored internet highways and data troves, you're going to have a hard time making something new.

As Landor & Fitch Executive Director of Insights & Analytics, Americas Maarten Lagae advises, don’t rely on convenient data for strategic decisions:

If you’re planning to manage a brand by simply looking at social media data, you might as well drive your car on the highway just using a flashlight…It requires more rigor, time and resources to find multi-faceted answers and develop solid business cases that unlock budgets, board approval and ultimately business growth.

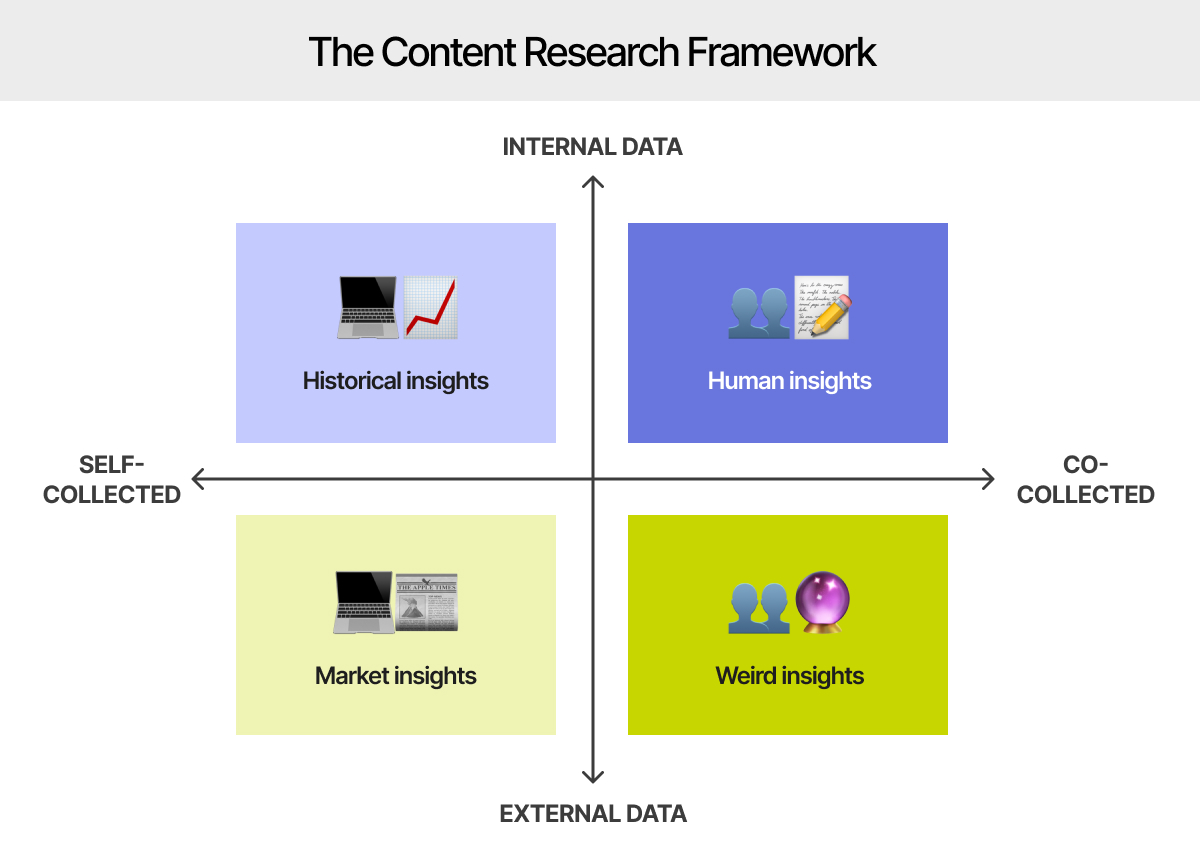

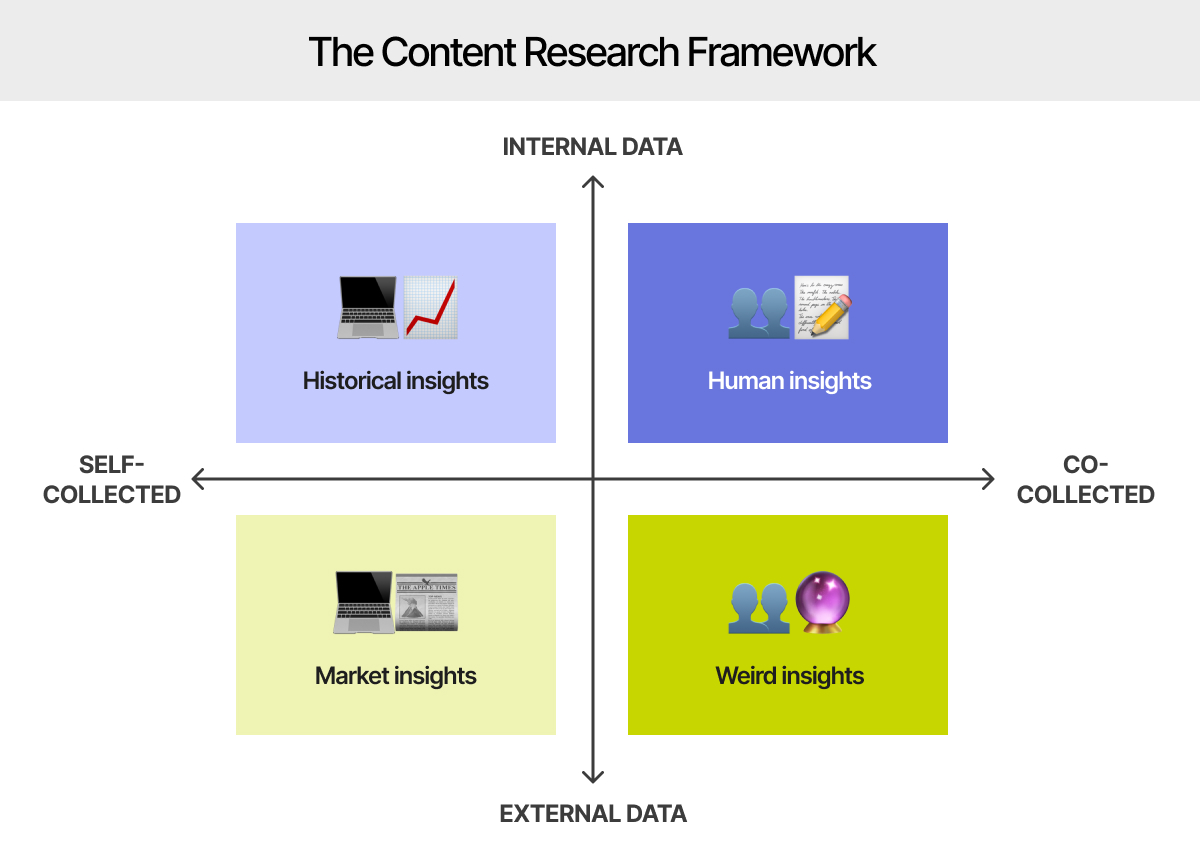

Not every content professional has a research team feeding into their work. If you need to seek out project insights yourself, this content research framework will help you find the right data—not just convenient data—for content strategy that makes a difference.

Today, you'll learn:

- How to diversify your inputs and do better work in an era of homogenization

- How to source the right data and maximize insight

- How to use the content research framework — with examples of using both qualitative and quantitative methods across business use cases: brand positioning, performance reporting, tactical copywriting, campaign dreaming

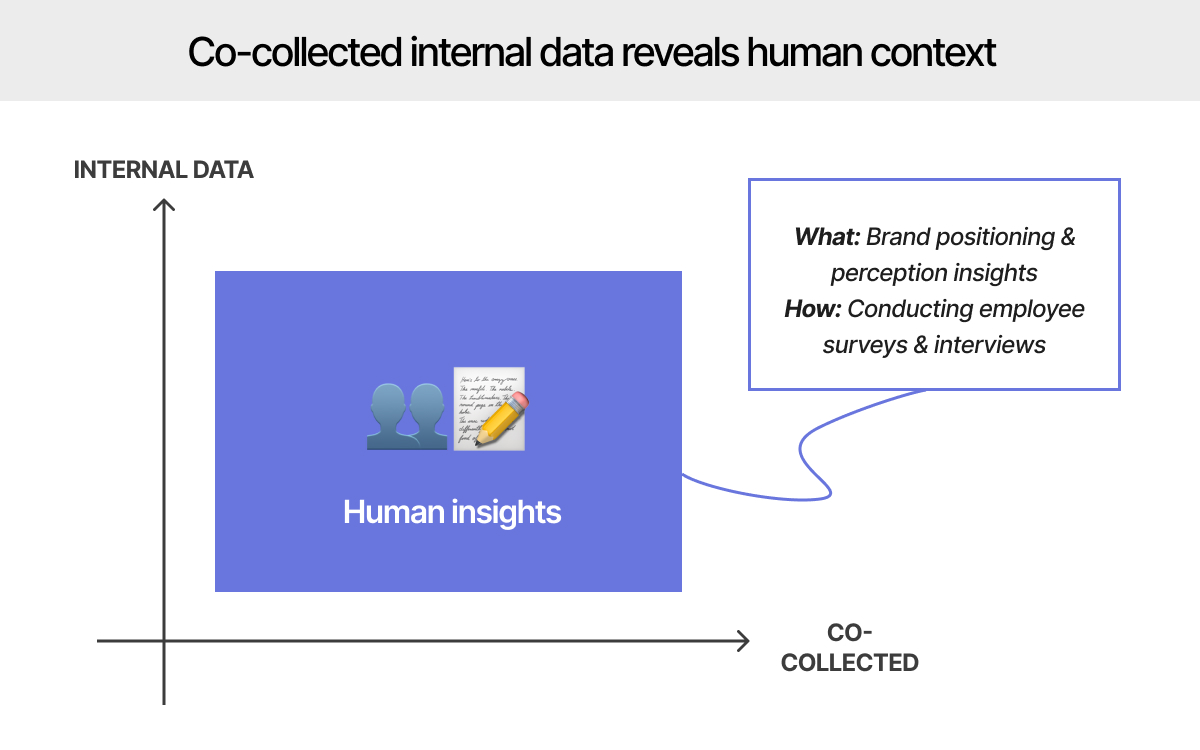

Co-collected internal data reveals human context

What: Qualitative brand positioning and perception insights

How: Conducting internal employee interviews and surveys

When: During onboarding audits and key company moments like a rebrand, strategy pivot, or new product launch

Why: To understand the human dynamics behind brand perception.

Questions to answer: How does external brand positioning match internal perception? Where are the gaps and opportunities to bridge this? What are the underlying organizational norms or cultural biases behind company language?

Whether you've just joined a company or started consulting for one, consider who might be able to offer brand perception insights, outside of your main stakeholders or collaborators.

Employee interviews are an effective way to glean brand insights, but they're also time-intensive. You might not be able to get a 30-minute interview with senior stakeholders across teams, or you might not think to spend time with more junior team members.

Complementary mini-surveys can scale insights and surface trends faster than conducting individual or group interviews. You could also run a survey first, and then use trends from the findings to inform the questions you ask in deep dive interviews.

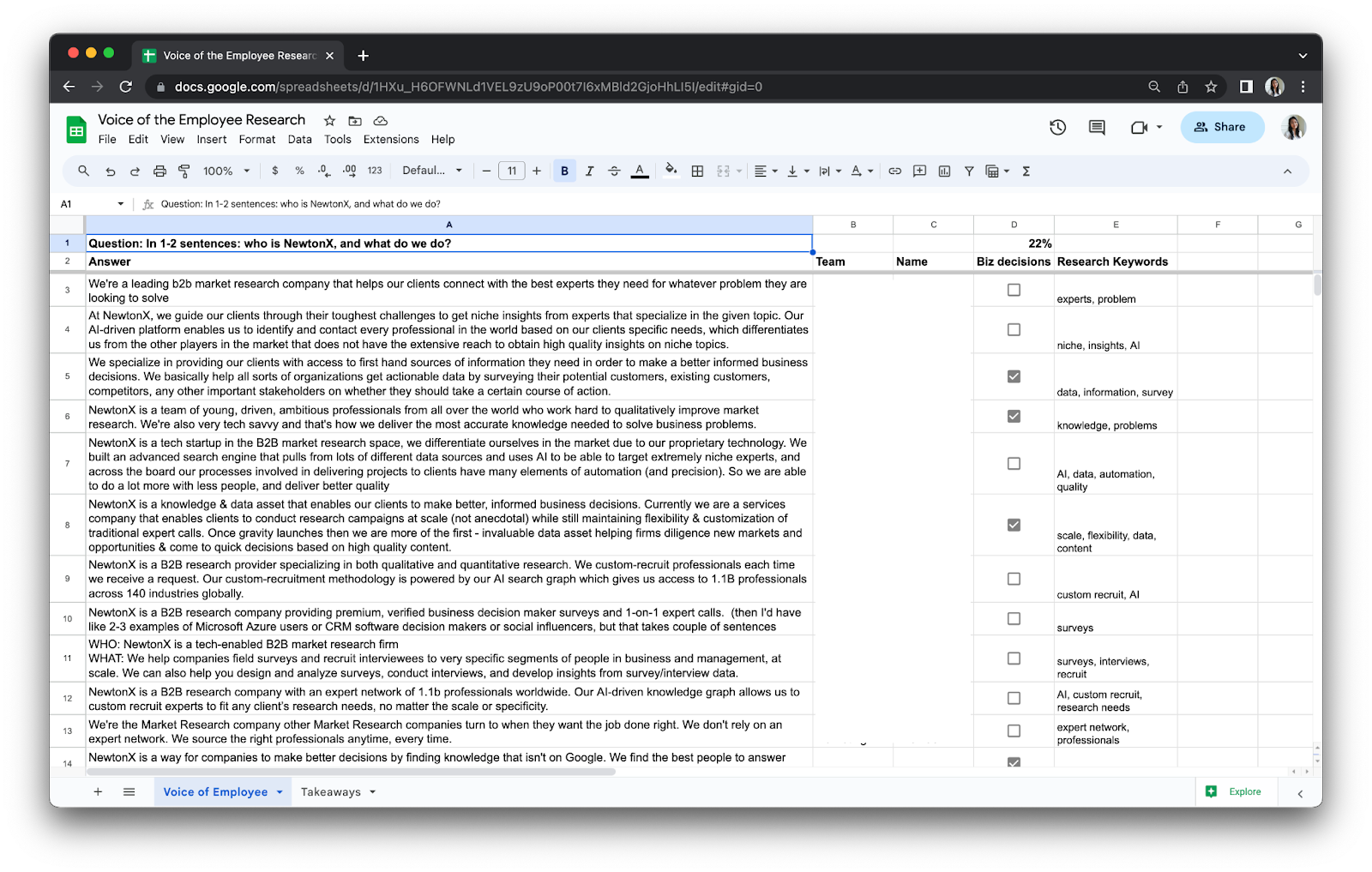

Try asking employees to describe the company's value proposition in one or two sentences. Pretend they're introducing the organization to a prospect at a conference, without looking at the website for reference.

Collect the survey responses in a spreadsheet and note keyword trends. See where it deviates from the language you're hearing from executives. Make a checkbox to mark how many employees mirror executive phrasing, and see what percentage it is. Don't be surprised if it's just 1/4 of the company. That gives you a sense of how far the vision has trickled down, and where the reconciling work is to be done.

For sample size, be strategic. You don't need a huge sample if you're talking to key stakeholders who have influence on decisions and team training. And if you'll be manually analyzing open-ended responses, 15–20 respondents is a good cap to protect your own time while still getting an accurate look at the brand.

Self-collected internal data reveals historical context

What: Quantitative brand and content performance insights

How: Pulling metrics from tools across the organizational tech stack

When: Onboarding audit, and key reporting moments that inform future strategy (e.g. an end of year review)

Why: See where past actions went right or wrong, so you can double down on the right and avoid the wrong.

Questions to answer: What strikes you about the data? What validates your intuition or surfaces new insight? How might these findings back your next decisions with confidence?